summary:

As the global climate change challenge becomes increasingly severe, in addition to the increasing attention paid by governments to issues related to the protection of the earth's environment and sustainable development, companies are also responding to the responsibility of reducing greenhouse gas emissions. In February this year (112), our country passed the "Climate Change Response Act", which clearly stipulates the net zero emission target for 2050 and authorizes the formulation of sub-laws and regulations related to carbon pricing and management. In order to encourage companies to achieve the net zero emission target, the government will launch the operation of carbon rights and carbon trading markets to assist companies in net zero transformation and reduce the impact of climate change. Although the government's carbon reduction policies mostly prioritize large enterprises or emission sources, small and medium-sized enterprises are still part of the supply chain and must also face the requirements of customers to reduce carbon emissions. Therefore, small and medium-sized enterprises must also grasp the international pulse (CBAM, etc.) and domestic relevant laws and regulations (such as carbon fee collection, reduction quota transfer, trading or auction, etc.) to understand their own risks and impacts, and make corresponding responses to carry out net zero transformation as early as possible and create green business opportunities.

I. Background

As the challenges of global climate change become increasingly severe, in addition to the increasing attention paid by governments to issues related to environmental protection and sustainable development, companies are also responding to the responsibility of reducing greenhouse gas emissions. In addition, Taiwan has also responded to the major countries in the world promoting net zero emissions related goals, strategies and mechanisms. In February this year (112), the "Climate Change Response Act" was passed. In addition to incorporating the 2050 net zero emissions target into the law, it also authorized the formulation of sub-laws and regulations related to carbon pricing and management, such as total amount control allocation, carbon fee collection, voluntary reduction projects to obtain carbon reduction quotas, carbon trading platforms and other mechanisms.

However, the government's push for carbon reduction policies and businesses' commitment to environmental sustainability directly impact their operating costs and management strategies. In particular, the operational mechanisms and development of carbon credits and carbon trading markets will generate both risks and opportunities for businesses related to carbon management, and will play a crucial role in ensuring the implementation of reduction targets. In short, the carbon trading market is a key tool in carbon reduction strategies. Not only does it contribute to global efforts to achieve net-zero emissions, it also promotes the development of low-carbon industries and economies worldwide, mitigating the impact of climate change.

II. Carbon Pricing Tools and Carbon Rights:

1. Carbon Pricing Tools

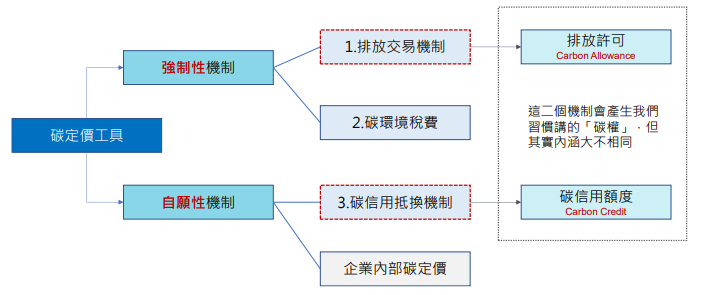

The carbon pricing mechanism is a policy tool for carbon reduction. By setting a carbon emission price, the external carbon emission costs can be internalized to encourage all parties to reduce greenhouse gas emissions. The main international carbon pricing tools are mainly divided into mandatory and voluntary mechanisms. Mandatory mechanisms include carbon taxes (fees) and carbon emissions trading. Carbon taxes (fees) refer to government-imposed fees on carbon emissions, which are levied based on the amount of carbon emissions or carbon content, thereby encouraging companies and individuals to reduce carbon emissions and reduce the costs derived from carbon emissions; on the other hand, carbon trading is a market mechanism in which the government issues emission quotas (Carbon Allowances) to companies, allowing companies to trade, purchase additional carbon emission rights or sell excess carbon emission rights to ensure compliance with their own emission limits. Voluntary mechanisms include carbon credits and internal corporate carbon pricing. Carbon credits refer to companies that are not subject to government regulation but implement emission reduction measures and achieve concrete carbon reduction results. These can be converted into carbon credits after certification. Internal carbon pricing is the establishment of a carbon emission charging mechanism for internal units or departments to incentivize each business unit or department to take emission reduction measures.

(Figure 1) Carbon Pricing Tools

In order to seek cleaner ways of using and producing energy, and thus improve energy efficiency, a carbon pricing mechanism is one of the key strategies for responding to climate change and achieving net-zero emissions. The operation and development of the carbon trading market provides economic incentives, prompting governments and businesses to work together to reduce carbon emissions. Because high carbon prices mean high costs, this will force businesses to actively seek cleaner ways of using and producing electricity, and further promote the research and development of low-carbon technologies to achieve emission reduction targets. Secondly, the regulatory mechanism of the carbon trading market will help regulated businesses achieve their emission reduction targets. In addition, the income from the operation of the carbon trading market, such as transaction fees, will also provide the government with the necessary funds to combat climate change and contribute to the research and development and application of low-carbon technologies.

2. Carbon Rights

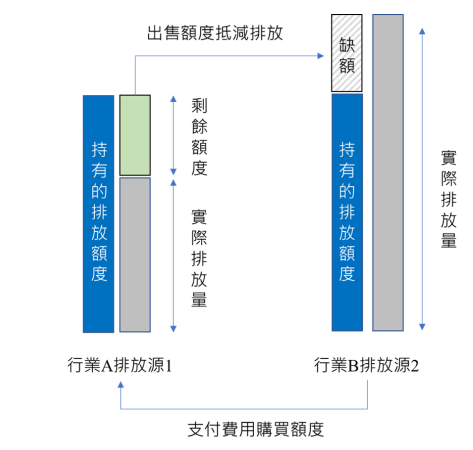

"Carbon rights" are the main trading targets in the carbon trading market. In essence, "carbon rights" are the emission allowances (Emission Allowances) issued by the government to regulated enterprises based on the current total emission limit (Cap) when implementing the "Cap and Trade" mechanism (Cap and Trade). If the actual emissions of a regulated enterprise in a current period exceed the current emission allowance, it must purchase emission allowances from the carbon trading market to meet the current quota; conversely, if the regulated enterprise has surplus allowances, it can sell emission allowances through the carbon trading market. Another type of "carbon right" is the carbon offsets (Carbon Offsets) obtained by enterprises through the implementation of voluntary emission reduction projects. This is completely different from the carbon rights in the cap and trade mechanism, and the method of use is also different.

(Figure 2) Carbon Credits Created by Total Cap Emissions Trading

Therefore, in the process of implementing net zero emissions, companies can adopt appropriate carbon pricing tools based on their own carbon reduction plans and financial situations to reduce the risks of their net zero transition.

III . Operational mechanism and current status of carbon trading market

1. Operational Mechanism and Trends of the International Carbon Trading Market

The operation of national or regional carbon rights exchanges is mainly to provide a platform for carbon rights trading and transfer. It is an environmentally beneficial financial market. Its main goal is to serve as a supplementary mechanism for greenhouse gas reduction strategies to assist companies in achieving net zero emissions goals.

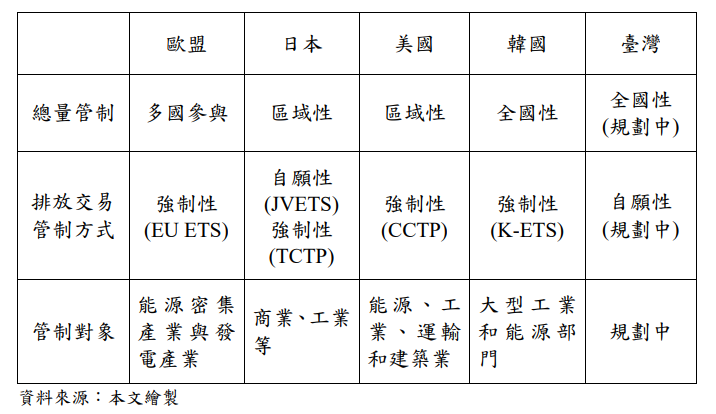

The European Union Emissions Trading System (EU ETS) is one of the world's largest carbon trading markets and the first multinational system, covering all 28 EU member states. The EU ETS allocates emission permits to regulated companies by establishing a cap on total carbon emissions. The EU gradually reduces the number of available emission permits to ensure that emission reduction targets are met. Furthermore, the EU ETS incorporates market stabilization mechanisms, such as a carbon price floor, to maintain the stability of ETS carbon prices. Since its establishment in 2005, the EU ETS has regulated approximately half of the EU's total CO2 emissions (covering energy-intensive industries and power generation). To date, total emissions from regulated entities have decreased by approximately 41%. In 2022, the European Commission proposed a 61% emission reduction target for regulated entities by 2030.

The United States' carbon trading market is relatively fragmented, allowing each state to adopt different management approaches. California's cap-and-trade program (CCTP), established in 2012, is the world's fourth-largest carbon emissions trading system, behind only the European Union, mainland China, and South Korea. CCTP also participates in the Western Climate Initiative (WCI) and is linked to the Quebec Province of Canada's cap-and-trade system, making CCTP the first cross-regional cap-and-trade system in North America. CCTP also establishes a total emissions cap and allocates emission permits to regulated companies. CCTP currently covers a wide range of industries, including energy, industry, transportation, and construction. In response, the U.S. federal government has begun reconsidering the planning of a national carbon market to address climate change and achieve the nation's net-zero goal.

The Japan Voluntary Emissions Trading Scheme (JVETS) ran from 2005 to 2012. Participating companies were required to implement energy-efficiency improvements and adhere to greenhouse gas reduction targets. During the period, the program achieved a carbon reduction of 1.89 million tons and approximately 260,000 tons in trading volume. Separately, the Tokyo Metropolitan Environment Bureau (Toukio Tokankiyoku) launched the mandatory Tokyo Cap-and-Trade Program (TCTP) in 2010. This program regulates energy consumption and greenhouse gas emissions from commercial, industrial, and public sector buildings within Tokyo, setting a 25% greenhouse gas emissions reduction target by 2020 compared to 2000 levels. By 2017, emissions had been reduced by 27%. In addition, the Tokyo Stock Exchange also announced that it will launch carbon rights trading on October 11, 2023, which will be Japan's first carbon market established on an exchange.

South Korea launched the Korea Emissions Trading Scheme (K-ETS) in 2015, establishing a five-year national emissions quota system and a trading system for emissions permits. K-ETS covers large industrial and energy sectors, such as energy, heavy industry, construction, the public sector, domestic air transport, and waste management, to encourage regulated companies to reduce greenhouse gas emissions. K-ETS is the second-largest carbon trading system in the world, second only to the European Union, and the first country in East Asia to establish a national carbon emissions trading system.

Table 1 Summary of carbon trading systems in various countries

In summary, the operating mechanism of the carbon trading market varies according to local conditions, but its purpose is to reduce the greenhouse gas reduction targets of the country or region and encourage regulated companies to actively implement carbon reduction measures to cope with the impact and influence of climate change.

2. Current Planning of my country’s Carbon Exchange

According to the Ministry of Environment, Executive Yuan, Taiwan, the Taiwan Carbon Solution Exchange (TCX) is being jointly established by the Taiwan Stock Exchange (TWSE) and the National Development Fund (Executive Yuan). It is scheduled to officially open at its headquarters in Kaohsiung City on August 7, 2023. Its primary business is to assist businesses in trading carbon credits domestically and internationally. As Taiwan has not yet implemented total emission control, the market is currently voluntary, initially focusing on providing carbon-related consulting and awareness activities.

However, in light of the net-zero emissions target, the EU Carbon Border Adjustment Mechanism (CBAM), pressure to reduce carbon emissions in the international supply chain, and related sub-legislation under the Climate Change Response Act, the initial planning phase of the TWSE will primarily focus on trading in international carbon rights. However, with the upcoming implementation of carbon fees, the carbon trading market will help further improve Taiwan's carbon pricing mechanism.

Therefore, the carbon credits TCX will currently be trading will be based on voluntary carbon credits, rather than mandatory carbon allowances. Therefore, TCX's carbon credits are currently primarily used for corporate carbon neutrality declarations and environmental impact assessment offsets. Furthermore, with the Ministry of Environment (EME) planning to launch a carbon fee collection mechanism in 2025, whether carbon credits purchased by companies can be used as offsets will depend on the passage of the relevant carbon fee sub-law (expected for the end of 2013).

IV. Enterprise Response Strategies and Future Development

Taiwanese companies play a crucial role in the international supply chain, primarily in the manufacturing sector. The international trend toward net-zero emissions and carbon management policies pose significant challenges to Taiwanese businesses. While carbon reduction policies often prioritize large enterprises or emission sources, the impact on small and medium-sized enterprises (SMEs), while less pressing than for large enterprises, remains a component of the supply chain and must face carbon reduction demands from customers. Furthermore, failure to promptly implement carbon management will negatively impact business operations. Therefore, SMEs must simultaneously monitor international trends (e.g., carbon pricing and auditing) and relevant domestic regulations (e.g., carbon fee collection, inventory and registration, incremental carbon offsets, voluntary carbon reduction programs, carbon reduction credit transfers, trading, or auctioning). This allows them to assess their own risks and impacts, develop appropriate responses, and promptly implement net-zero transitions to create green business opportunities.

Organizer: Ministry of Economic Affairs, SME Administration

Executing Unit: Plastics Industry Technology Development Center